The Illusion of Control

When I first entered the world of venture capital, I was filled with the optimism that all newcomers bring, an earnest belief that with enough knowledge and strategy, I could separate fleeting trends from enduring innovations. But after years in the space, I’ve learned that the venture capital industry, like much of the broader economy, is not driven by rational foresight, but by cycles of speculation, misallocation, and sometimes, self-deception. This revelation has transformed how I approach everything from investment strategies to portfolio management.

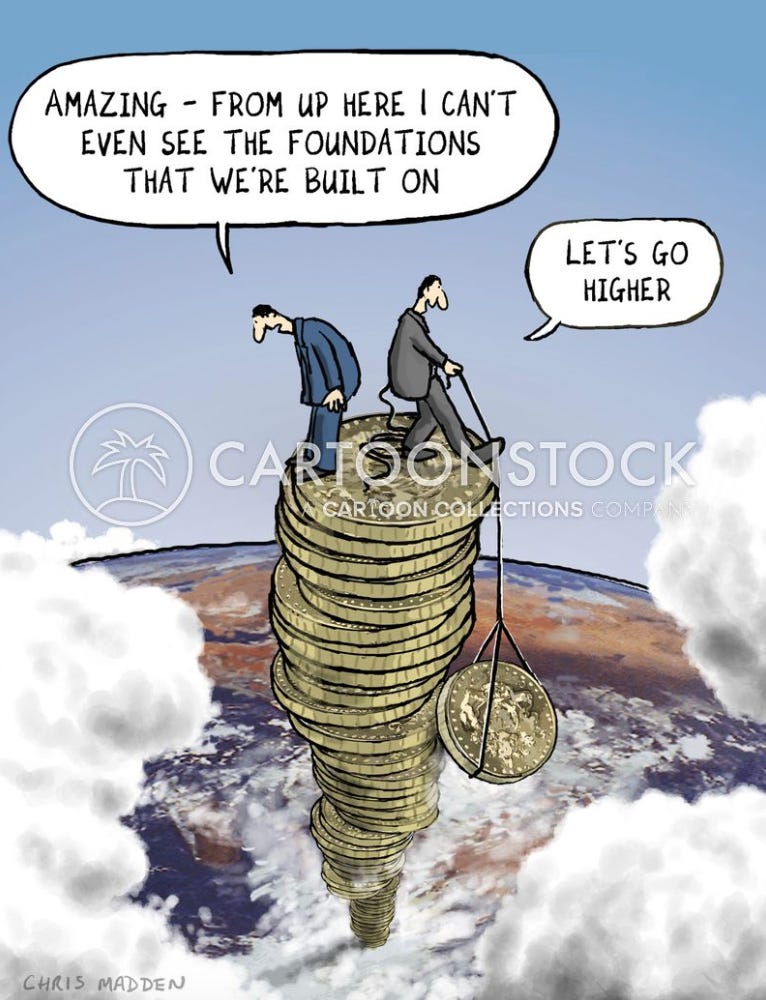

The most surprising lesson, however, has been how often the markets we participate in, though driven by the best of intentions, can become distorted by the same forces that have plagued economies for centuries: bubbles. These bubbles, much like air in an inflated balloon, are the hidden architecture of much of our financial system. They may well be the one constant in economic history, inflating, bursting, and reshaping everything in their wake.

The Bubbles We Ride: 17th Century to Present Day

The phenomenon of financial bubbles is far from new. From the speculative madness of Tulip Mania in the 17th century to the Dotcom Bubble at the turn of the millennium, and the 2008 financial crisis, economic history is rich with examples of speculative behaviour running amok. More recently, the rise and fall of the crypto market provides yet another textbook case. The core feature of all of these events has been the same irrational belief that prices, whether for assets or companies, will continue to rise, regardless of how overinflated they become.

Economists like Hyman Minsky and Paul Krugman have explored this recurring phenomenon in depth. Minsky’s theory of financial instability argues that during periods of economic prosperity, optimism leads to increasing borrowing, often beyond what is sustainable in the long term. When these bubbles inevitably burst, the financial repercussions are devastating, not only to markets but also to human capital. The term Minsky’s Moment, coined to describe the sudden realisation of financial instability, is a concept I’ve come to know all too well.

As Krugman further expanded, these cycles of boom and bust are not merely a byproduct of human folly, they are intrinsic to our economic system. The inevitability of bubbles, driven by human behaviour, is often treated as an unfortunate but natural aspect of financial life. However, the profound impact on society, especially in terms of lost opportunities, is harder to ignore.

Bankrupt but Breathing Companies (BBBCs): The Hidden Cost of Excess Capital

As I navigated the world of venture capital, I began to notice a troubling trend: an increasing number of “Bankrupt but Breathing Companies (BBBCs)”. These are businesses that, despite lacking any viable path to profitability, continue to exist, often sustained by an endless flow of speculative capital. They are not unlike zombies, but more dangerous: they drain resources from truly innovative companies and hinder economic dynamism.

BBBCs are kept afloat by cheap credit, which allows them to persist despite having fundamentally unsound financials. Private equity firms and venture capitalists, especially during periods of liquidity excess, often pour capital into these companies. But the investment is less about the company’s long-term potential and more about keeping it alive for the next round of refinancing. The cycle is self-perpetuating: these companies continue to raise funds without addressing their core inefficiencies.

The most immediate issue with this phenomenon is the human cost. When BBBCs monopolize available capital, they prevent talented individuals from contributing to companies that have a genuine path to growth. In turn, this stifles the emergence of innovative startups and restricts the broader economy from reaching its full potential.

At a personal level, I’ve seen the effects on the workforce. Talented individuals get stuck in roles that offer no real opportunity for growth. Burnout sets in, demotivating the next generation of professionals before they even step into the arena. This cycle of stagnation only reinforces the status quo.

Capital Misallocation: A Breeding Ground for Inefficiency

Capital misallocation is one of the most insidious effects of the speculative bubbles that bubble to the surface during periods of excess liquidity. While the endless funding of BBBCs is one example, the broader economy also faces significant misallocation in other asset classes. Over the past two decades, a savings glut has led to an over-investment in secondary assets, stocks, real estate, and other speculative vehicles, while primary capital (investments in new technologies, productive enterprises, and human capital) has often been neglected.

This over-focus on asset inflation has had troubling effects on economic dynamism. Excess liquidity has inflated asset prices without creating real value, while productive investment in areas like infrastructure, education, and entrepreneurship has stagnated. The consequences are not only financial; the ability to grow sustainable businesses and generate wealth through innovation is undermined by the allure of speculative quick returns.

But perhaps the most worrying aspect is that the misallocation of capital prevents the reinvestment of human capital into sectors where it’s most needed. Industries that offer long-term growth potential and require innovation are often overshadowed by the immediate returns of asset classes that provide less sustainable value. This not only slows economic progress but also stunts the career potential of workers, whose talents are deployed in the wrong areas.

The Human Capital Trap: Labor’s True Potential Is Left Untapped

In my experience, the overvaluation of companies and the practice of funding BBBCs distorts the true value of human capital. Talented individuals are often trapped in roles that stifle growth and skill-building. Entrepreneurs with transformative ideas struggle to secure funding, as they are overshadowed by companies that are far more adept at accessing capital, but that ultimately offer little long-term promise.

Adam Smith, Thomas Piketty, and other economists have long argued that labor, the creative, intellectual, and entrepreneurial potential of individuals, is the primary driver of economic growth. But when capital is misallocated, this resource is left untapped, and society as a whole suffers. Innovations that could improve lives, build sustainable businesses, and create new industries are left underfunded, while labor remains stagnant in sectors that only offer short-term gains.

Breaking the Cycle: Can We?

Reflecting on these trends, it becomes evident that the financial system is in need of significant reform. The speculative bubbles, the misallocation of capital, and the wasting of human potential are all symptoms of the same underlying issue: an economic model increasingly detached from the realities of innovation and long-term value creation.

We need to shift our definition of value, moving away from asset prices and speculative investments toward sustainability, productivity, and innovation. As Bill Janeway argues in his book Doing Capitalism in the Innovation Economy, innovation itself is cyclical and requires regulatory oversight to ensure that speculative bubbles don’t stifle progress.

“Innovation is only possible within a framework of regulatory stability,” Janeway writes.

Without this framework, we continue perpetuating an economy that solves none of its structural problems.

The Future of Capital and Innovation

While the financial system will always find ways to misallocate capital during periods of excess, it doesn’t have to be this way. By shifting focus from short-term profits and speculative bubbles to long-term value creation, we can build a more sustainable economy, one that prioritises human capital, productivity, and real innovation over speculation and excess.

It's time to reassess how we allocate both financial and human capital. Only then can we break free from the cycles that have long stunted our economic potential.

If we are serious about building an economy that serves the broader good, we must face the uncomfortable truth: bubbles are not just financial phenomena, they are symptoms of a system that needs a reset.