In the dynamic world of global venture capital, FY24-25 has emerged as a year of recalibration and resilience. From the tech corridors of Washington D.C., now abuzz with high-stakes political and corporate manoeuvring, to the vibrant startup ecosystems of India, venture capital has experienced tectonic shifts. A confluence of economic fluctuations, geopolitical tensions, and technological innovations is shaping a new normal for investors and entrepreneurs alike.

Global Venture Capital: A Year of Rebound and Realignment?

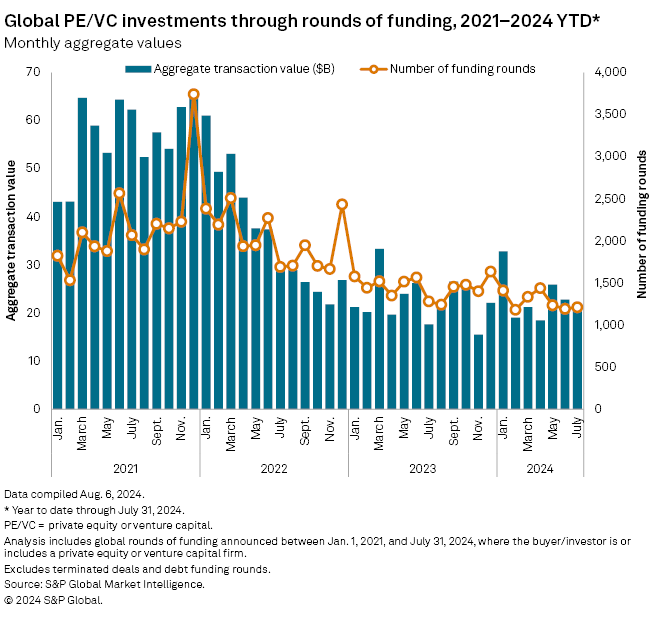

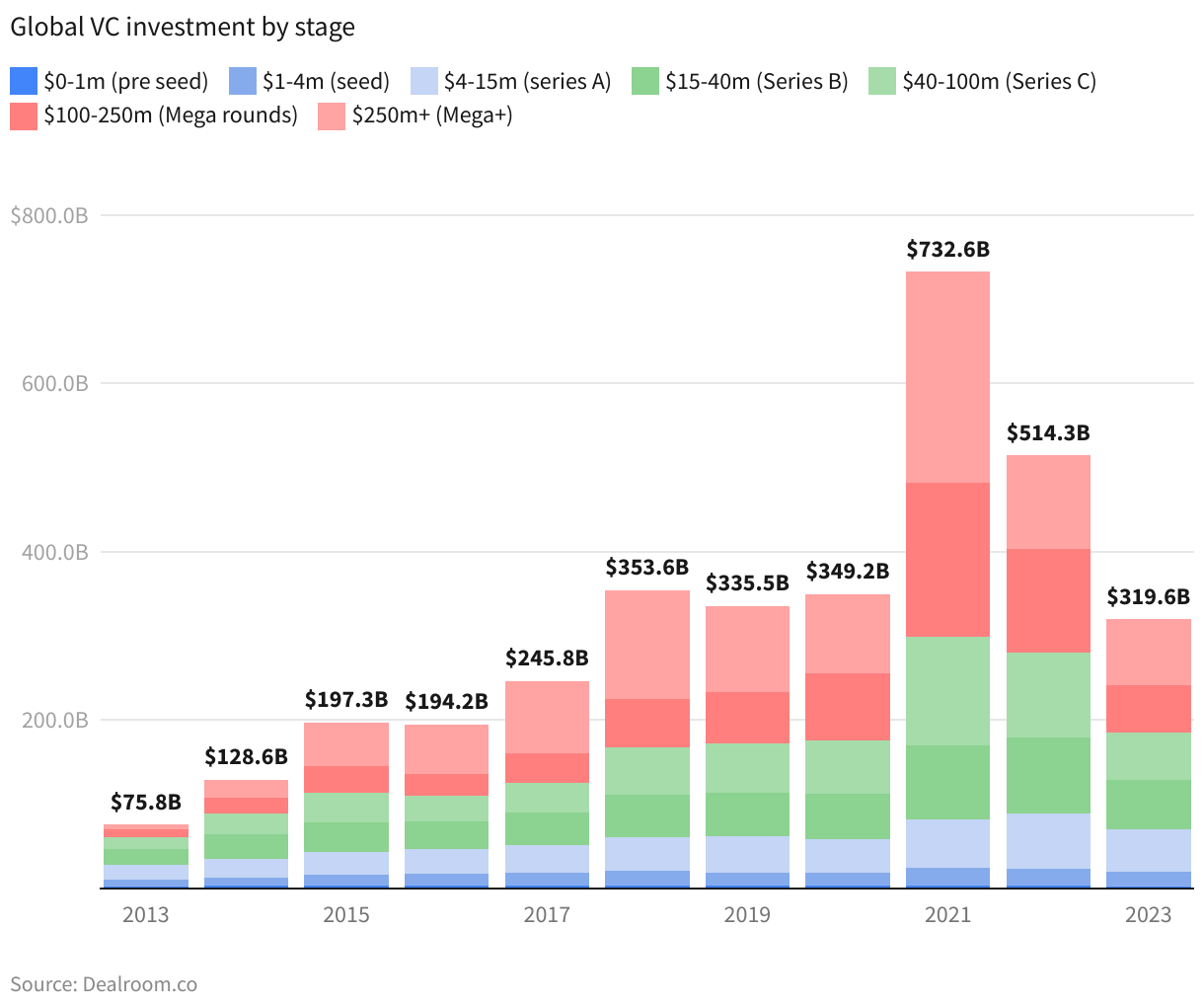

After a tumultuous period, the venture capital industry is showing signs of recovery. According to KPMG, total global VC investment climbed to approximately $368.3 billion across 35,684 deals, marking an increase from $349.4 billion across 43,320 deals in 2023. While deal volume declined, capital deployment rose, reflecting a shift towards more selective, high-conviction investments. The industry’s resurgence has occurred despite – or perhaps because of – widespread geopolitical tensions and uncertainties surrounding major elections, including the U.S. presidential race in late 2024.

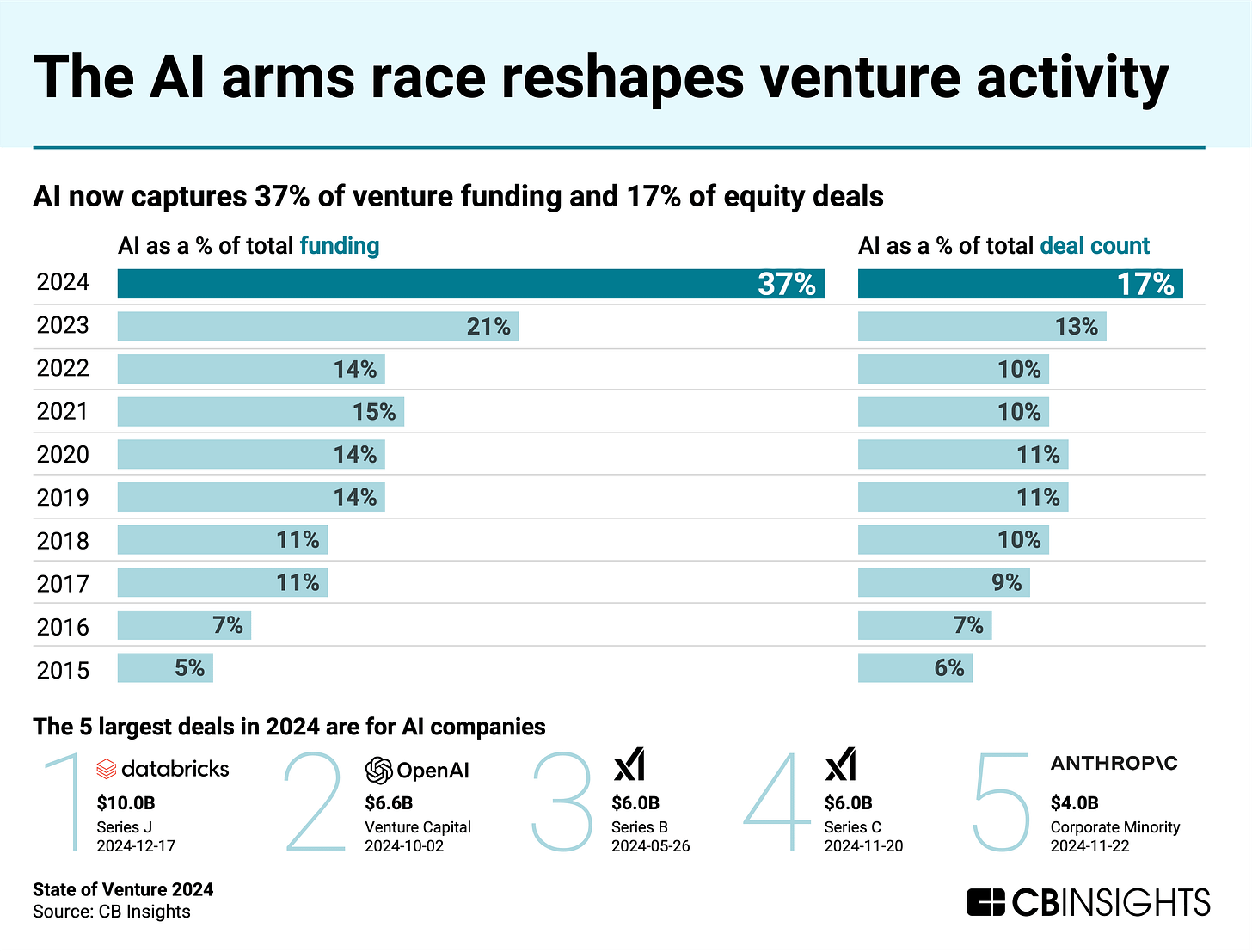

Artificial intelligence (AI) has played a pivotal role in this rebound. AI startups alone captured nearly a third of all global VC funding, with investments surging by over 80% year-over-year. Industry leaders such as OpenAI, xAI, Databricks, and Anthropic collectively raised upwards of $40 billion, underscoring AI’s continued magnetism for capital. Investors see AI not just as a technological advancement but as a foundational shift akin to the advent of the internet. According to Barron’s, the fervour for AI is showing no signs of cooling, with sovereign wealth funds and institutional investors increasing their allocations in this space.

Yet, beyond AI, the global venture landscape remains uneven. The IPO market continues to pose challenges. Despite a few standout public listings, many late-stage startups are delaying their exits, wary of lacklustre public-market performance. Companies like CoreWeave, the New Jersey-based AI-infrastructure firm, have opted to raise substantial private capital instead – securing $2.3 billion in debt financing – rather than rushing into an uncertain IPO landscape. The Financial Times notes that a growing number of firms are opting for alternative liquidity routes, such as structured secondaries and private M&A transactions, rather than risk an underwhelming IPO reception.

India’s Startup Ecosystem: Navigating New Currents

India’s startup ecosystem is experiencing a shift that is both subtle and profound. While total startup funding rose by 6% to $11.3 billion in FY24-25, seed-stage investments plummeted by 25%, signalling a strategic realignment among VCs. The prevailing sentiment among investors is to double down on pre-IPO and late-stage startups that offer clearer paths to liquidity, rather than riskier early-stage ventures.

This pivot is happening against a backdrop of evolving macroeconomic conditions. Higher borrowing costs, longer gestation periods for deep-tech startups, and a rising cost of technical talent have led to a flight to quality. Investors are more discerning, favouring founders with strong track records and robust unit economics. However, not all sectors are feeling the pinch.

Health-tech, climate-tech, and fintech continue to attract substantial capital, driven by India’s rapid digitalisation and evolving regulatory landscape. In health-tech, Qure.ai secured $100 million to expand its AI-driven diagnostics, while Tata 1mg raised $40 million to scale its e-pharmacy and lab testing services. Climate-tech is also seeing momentum – BluSmart raised $42 million to grow its EV ride-hailing fleet, and ElectricPe secured $15 million to enhance EV charging infrastructure. In fintech, however, cracks are emerging. While Pine Labs raised $150 million to deepen its merchant payments ecosystem, consumer-facing platforms like Cred are grappling with sustainability concerns, with mounting losses and slowing user growth prompting questions about long-term viability.

Meanwhile, women-led startups raised over $523 million across 75 deals in the first half of 2024 – an 81% increase from the previous year – indicating a growing shift toward diversity in venture financing. However, not all have found lasting success; SALT, a women-focused finance platform, recently shut down, citing challenges in user acquisition and retention.

The mixed fortunes of these ventures highlight both the evolving investor appetite and the need for startups to demonstrate capital efficiency and clear profitability roadmaps in an increasingly cautious funding environment.

Emerging Trends and Future Outlook

Several key trends are shaping the next phase of venture capital:

The Rise of Specialised Funds and Micro VCs: The era of generalist investing is waning, giving way to niche-focused funds that provide deep sectoral expertise. Whether in AI, climate-tech, or industrial automation, these specialised funds are enabling early-stage startups to experiment with innovative business models without the pressure of immediate commercialisation.

Corporate Venture Capital’s Expanding Role: Large enterprises are no longer just investing in startups; they are integrating them into their strategic roadmaps. According to Eximius.vc, corporate venture capital (CVC) participation in startup funding rounds has reached an all-time high, with firms like Reliance, Tata, and Google India leading the charge. This symbiotic relationship provides startups with not just capital but crucial go-to-market support and distribution advantages.

The Return of Diaspora Entrepreneurs: A fascinating trend is the repatriation of Indian entrepreneurs who previously built careers in Silicon Valley. Drawn by favorable economic conditions, proactive government initiatives, and a maturing domestic ecosystem, these founders are bringing back global playbooks, building scalable ventures in India. Business Insider reports that this ‘reverse brain drain’ is expected to drive a new wave of cross-border innovation.

Where Does the Evolution Go from Here?

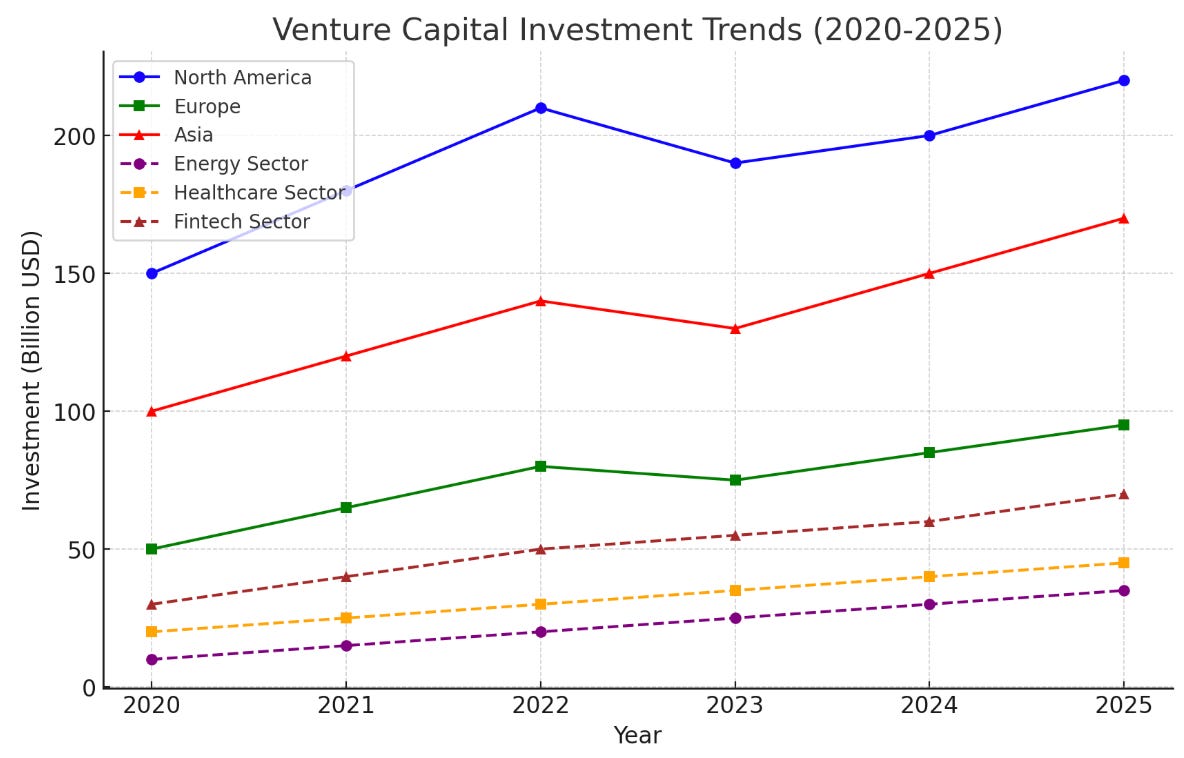

As venture capital continues its recalibration, the emphasis will be on strategic patience and prudent capital deployment. Investors who once pursued growth-at-all-costs are now more discerning, favouring companies with clear profitability roadmaps. AI will remain at the centre of investment theses, but sectors like energy, healthcare, and fintech are poised to see renewed interest as well.

For India, the challenge will be to sustain momentum while addressing funding imbalances between early-stage and late-stage startups. Government interventions, such as Startup India and the SIDBI Fund of Funds, may play a role in cushioning seed-stage capital shortages. Meanwhile, as global capital pools diversify away from China, India stands to benefit – provided it continues to nurture an innovation-friendly policy environment.

For entrepreneurs and investors alike, FY24-25 is proving to be a year of reckoning and reinvention. Those who can navigate these evolving dynamics with agility and foresight will be best positioned to thrive in this new era of venture capital.